Tax & Financial Benefits of Eco-Friendly Landscaping in California: A Property Owner’s Guide

If you’re a property owner or investor in Northern or Southern California, strategic investments in your landscaping can have a positive impact on your capital gains tax. And eco-friendly landscaping can pay dividends in the form of local and state tax credits — not to mention a drastic reduction in your water usage. In this post, you’ll learn how Farmscape can save you 70% or more on your residential or commercial water bill. Our garden design team assembled this guide to offer tips and insights into how sustainable landscaping, including water-wise and energy-efficient practices, can pay off both in the short term and long run.

As you likely know, when you sell your house — including your primary residence, vacation or rental properties — you pay capital gains tax. The amount you pay is based on the difference between the sale price and your adjusted “basis,” or original purchase price. The basis is adjusted for key improvements you’ve made to the property over the years, such as remodeling your kitchen or making major landscaping improvements. Those adjustments can reduce your tax burden. (Maintenance work, such as paying to have your lawn mowed, does not qualify as a capital improvement.)

So, can your landscaping costs be deducted from capital gains? Possibly, but it may not be the best course for California residents — as we’ve learned from working with clients hand-in-hand for more than 15 years. While the IRS specifically lists outdoor enhancements such as landscaping or building a walkway as home improvements that adjust your basis and can cut your tax bill, there are other factors to consider.

One such factor is Prop 13, an amendment to California’s Constitution that was enacted in 1978 and greatly reduced local property taxes, capping them at 1%. Under Prop 13, claiming an offset in capital gains tax due to a major home landscaping project may trigger a reassessment, negating any possible financial benefit.

Still, good California landscaping offers significant financial and aesthetic benefits.

In this post, you’ll find out how Farmscape can save you 70% or more on your water bill for your home or commercial property. Our garden design team assembled this guide to offer tips and insights into how sustainable landscaping — including water-wise and energy-efficient practices — can pay off both in the short term and long run.

How Sustainable Landscaping Can Save You Money Today

Landscaping, like any home or business project, can be an expensive undertaking, and no matter your budget, everyone likes saving money. Short of getting California landscaping deductions from capital gains tax, sustainable landscaping can help stretch your dollar when you work with a modern, eco-friendly landscaping company.

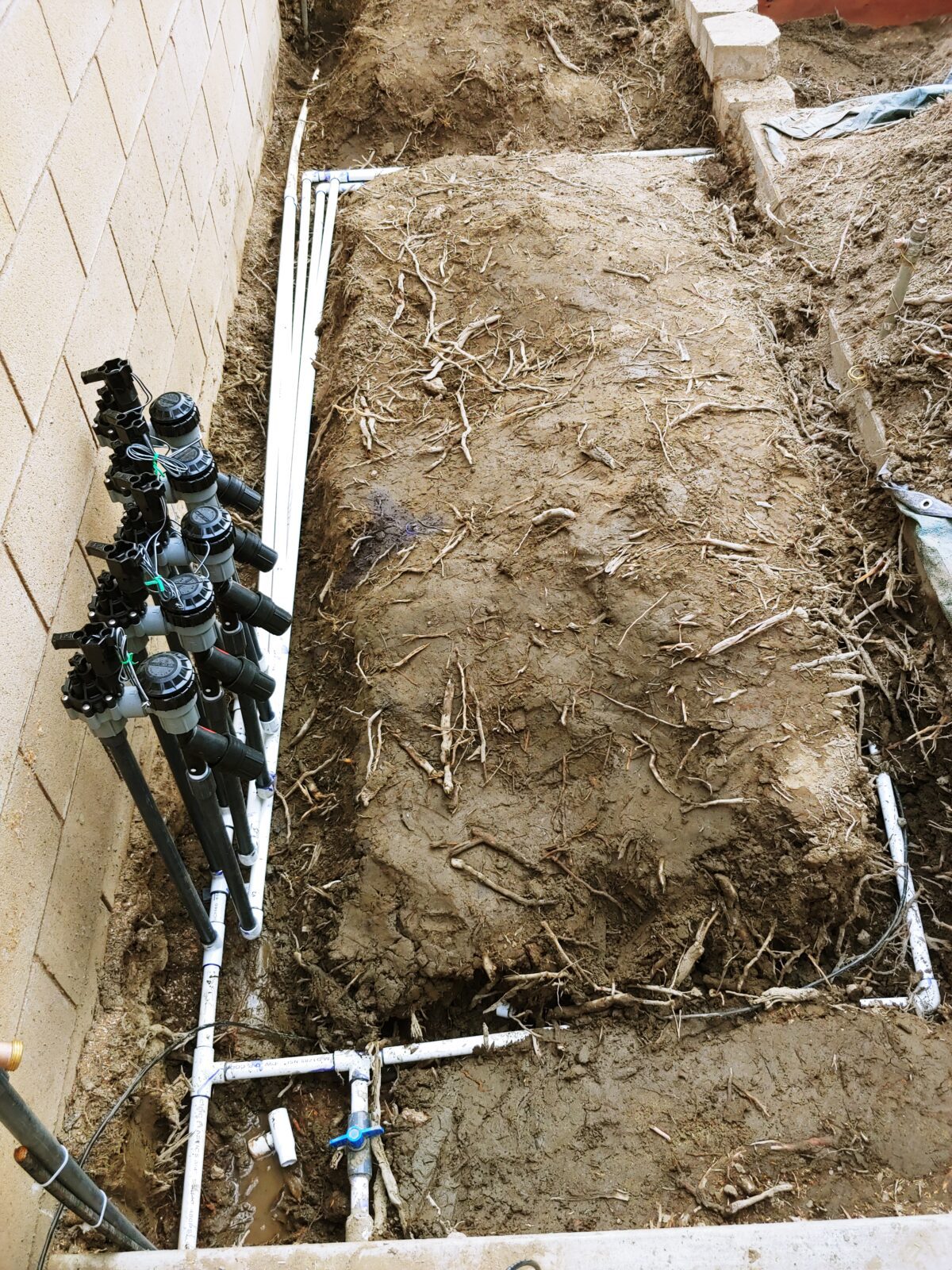

At Farmscape, we’ve traditionally helped homeowners reduce costs in a variety of ways. One way is by using natural materials in your landscape instead of expensive custom hardscapes. Another is to help lower your grocery bills by growing fresh, organic food on site. In addition, we apply water-wise practices to help dramatically cut your water usage through drip irrigation.

Water is a precious resource throughout the Western United States and will only become more relevant as climate change progresses in this century. It makes sense to get ahead of the curve and adopt a garden landscaping strategy that includes low-water, summer-dry native plants that can withstand periods of drought. This upfront investment can save you money on your water bills in the long run. Hiring a professional landscape design firm to calculate water usage for your property and design a drip irrigation strategy is also key.

Cost-Saving Success Stories in California Landscaping

Thanks to the level of detail — and data — provided by our sustainable landscape architecture program, we’ve had many clients who received anywhere from several hundred to several thousand dollars in rebates through their local governments. We have saved them up to 70% of their outdoor water usage by converting their thirsty lawns to low-water, edible landscapes irrigated by drip irrigation. And we have helped them sell their homes more quickly and for more money by increasing curb appeal and adding urban farm elements. All these financial incentives exist on top of the fact that you get to enjoy living the California dream in a Farmscape-designed residential landscape, and pass that on to the next generation of homeowners.

State and Local Rebates: Green Landscaping Incentives in California

While there isn’t a statewide landscaping tax write-off, California’s interest in sustainable landscape management provides some interesting incentives for homeowners. . Cal Water is currently offering $3 per square foot of turf removal when it’s replaced by low-water landscaping and drip irrigation — specialties of Farmscape. Many other municipalities have their own cash for lawn removal programs. Check in with yours or contact our team for assistance. We have had clients receive four-figure checks from their cities, counties and/or water districts in exchange for lawn removal.

In addition, many groups are offering to pay for weather-based smart controllers to minimize water usage. For example, SoCal Water$mart offers $80 per unit and $35 per station for replacing old irrigation timers with smart weather-based irrigation controllers, which are particularly beneficial for properties with less than 1 acre of landscape. Check with your local water company to see what eco-friendly landscaping techniques they are prioritizing — you’d be surprised at how much money is available in California for converting front yard landscaping to drought- tolerant landscapes.

Federal Tax Savings For Commercial Landscaping

In addition to state and local residential rebates, many of which can be stacked onto commercial properties, the federal government offers financial incentives for commercial sustainability and energy efficiency. The Commercial Buildings Energy-Efficiency Tax Deduction (Section 179D) provides up to $1.80 per square foot for renovation of commercial properties that improve energy efficiencies in various systems.

Additionally, green energy installations like solar panels or geothermal systems may be eligible for tax breaks under the Internal Revenue Code Section 48 Investment Tax Credit. These incentives align with sustainable practices and can indirectly support sustainable landscaping efforts.

Installation Services: Building Your Dream LandscapeBoosting Your Property Value in California

Apart from the potential tax advantages, well-executed landscaping can significantly enhance your property’s value in the California real estate market. As we’ve written in other blog posts, having a vivid, sustainable garden design can attract buyers to your property by enhancing curb appeal. Backyard landscaping can play a role in increasing the appeal of your home as well. Take a look through Zillow or Redfin and you’ll see homes from Marin to Orange County touting their modern landscape design, featuring mature lemon trees and raised beds alongside more traditional features like outdoor kitchens.

Contact Farmscape For Your Personalized California Landscaping Consultation

If you’re ready to be the steward of your particular landscape, grow great food and enjoy a fantastic environment full of food, flowers, trees and pollinators, why not engage with one of the most dynamic landscaping services in California? We are experts in Northern and Southern California landscaping and are among the best-rated landscaping companies in the state on Yelp and Google. Reach out today to discuss how Farmscaping can bring your residential or commercial project to life. We look forward to working with you!

Disclaimer

This guide is meant to provide helpful general information about landscaping tax deductions and rebates in California but is not intended as legal or tax advice. Please consult with your tax professional to get a complete understanding of which tax regulations and IRS deductions may apply to your situation.